Cash is king even in today’s digital age, especially when you’re running a small business. But managing your cash flow can be a daunting task. Small business owners face the dilemma of safeguarding their cash while also ensuring the operational aspects of their business are smooth and efficient. This is where money counting safes come into play. Not only do they offer a secure storage solution, but they also streamline the cash-handling processes. In this comprehensive guide, we’ll walk you through everything to know about money counting safes, including the various types available, what to look for, and best practices for using them.

Importance of Secure and Efficient Cash Management

Managing cash is not just about financial security; it’s also about customer trust and operational efficiency. Securely managing cash minimizes the risk of losses due to theft or errors, which can significantly impact your business’s bottom line. Moreover, an efficient cash management system ensures your customer transactions are smooth and that you can focus on other critical areas of your business. After all, manual counting and record-keeping tasks can be incredibly time-consuming and eat into the overall customer experience.

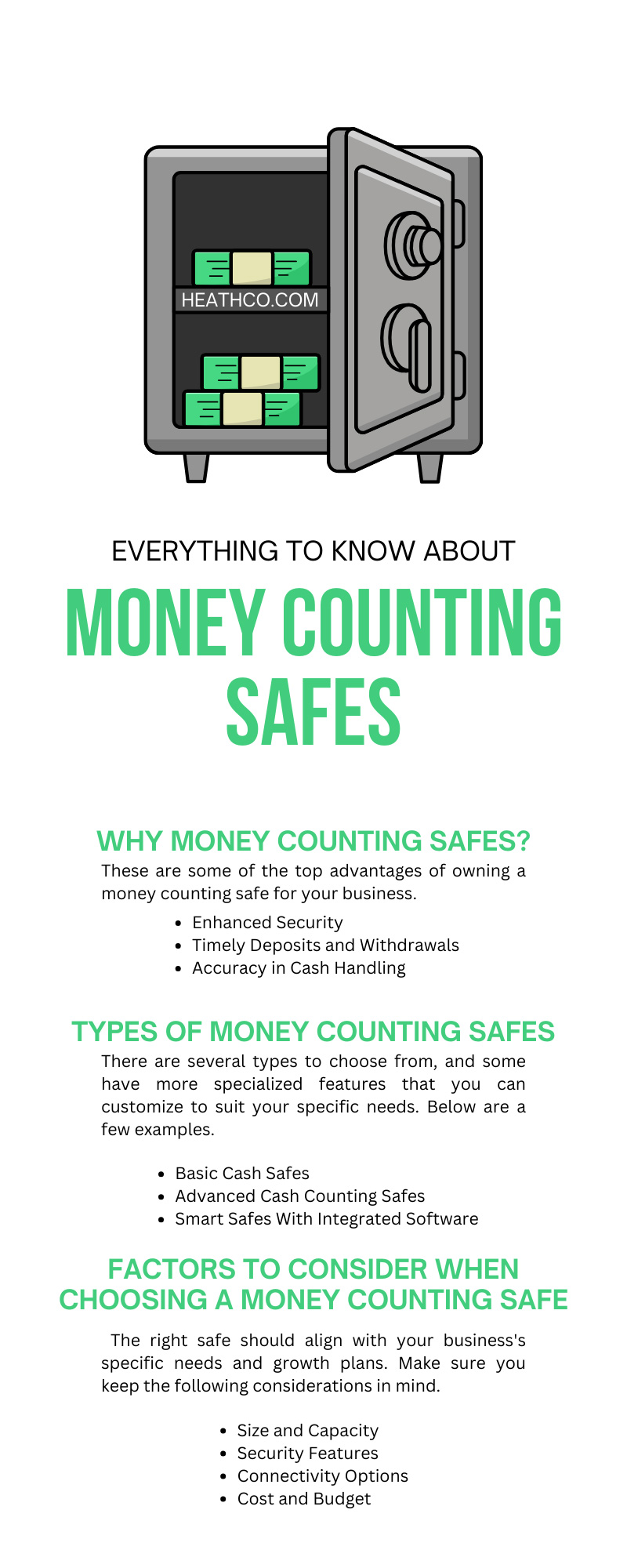

Why Money Counting Safes?

We all know that a safe is specially designed to store and protect money from thieving hands. However, with the incorporation of modern technology, safes can now effectively count your earnings so that you don’t have to. These are some of the top advantages of owning a money counting safe for your business.

Enhanced Security

First and foremost, money counting safes are essential for any business handling cash. They offer a secure location to store money, protecting it from both external and internal threats. Cash counting safes often come with security features such as biometric locks, time-delay systems, and dual-check deposits to ensure your cash is always out of harm’s way and accessible only to authorized personnel.

Timely Deposits and Withdrawals

Time is money, and in the context of small business operations, this adage couldn’t be more accurate. Money counting safes automate the process of counting and sorting cash, which can save hours of manual labor per week. Plus, the time spent on cash management is drastically reduced with advanced features like batch counting and currency detection. This allows your staff to focus on customer service and revenue-generating activities.

Accuracy in Cash Handling

In addition to taking up precious minutes, manual cash counting is also prone to human error. Even small discrepancies can add up over time, leading to significant financial losses. Money counting safes ensure accuracy in counting, sorting, and storing cash, which not only prevents losses but also builds a strong foundation for reliable financial reporting and auditing.

Types of Money Counting Safes

Once you commit to purchasing a money counting safe for your business, you need to determine which one you want. There are several types to choose from, and some have more specialized features that you can customize to suit your specific needs. Below are a few examples.

Basic Cash Safes

These are the entry-level money counting safes that offer a step up from traditional manual counting. They typically have a limited feature set, focusing on secure cash storage and basic counting functionalities.

Advanced Cash Counting Safes

With increased capabilities, these safes offer higher precision in counting and can handle larger volumes of cash. They often include advanced security features and can range from being standalone to network-connected for data tracking.

Smart Safes With Integrated Software

The epitome of modern cash management, smart safes boast not only the highest level of security and counting accuracy but are also integrated with sophisticated software solutions. This allows for real-time tracking of cash transactions and usually provides insights into your cash flow and business operations that can be invaluable for making strategic decisions.

Factors To Consider When Choosing a Money Counting Safe

Selecting the right money counting safe for your small business involves more than just picking a sturdy box. The right safe should align with your business’s specific needs and growth plans. Make sure you keep the following considerations in mind.

Size and Capacity

Consider the volume of cash transactions your business handles on a daily basis and make sure the safe’s size and capacity match those needs. If the safe is too small, you’ll quickly outgrow it; too large, and you might be allocating needless space that you could use for other things.

Security Features

The level of security you require depends on various factors, including the nature of your business and its location. Evaluate features like locking systems, alarm notifications, and fireproofing to ensure your safe can protect your assets.

Connectivity Options

In the digital age, connectivity is key. Decide if you need a safe with the ability to connect to your business’s network for data tracking or if standalone operation is sufficient. This choice will greatly influence the functionality and price of the safe.

Cost and Budget

Your budget will ultimately determine which type of money counting safe you can afford. However, it’s crucial to balance the initial cost with the long-term ROI in terms of savings on time, labor, and security.

Best Practices for Using Money Counting Safes

Purchasing a money counting safe is just the first step. In order to know everything about money counting safes, you also need to familiarize yourself with how to optimize its use. These are some crucial things to remember.

Regular Maintenance and Servicing

Like any equipment, money counting safes require regular maintenance to ensure they function properly. Stay on top of servicing schedules to avoid unexpected downtime that could disrupt your cash-handling processes.

Staff Training and Accountability

Your safe is only as good as the people using it. Train all staff members to operate the safe correctly and teach them the overall importance of secure cash handling. Implementing accountability measures will also help prevent misuse or theft.

Integration With Cash Management Systems

If you’ve invested in a smart safe, make the most of it by integrating it with your cash management software. This not only eases the administrative burden but gives you real-time visibility into your cash flow, simplifying your financial management process.

Safes are essential for small businesses looking to streamline cash management, enhance security, and promote efficiency. By investing in the right money counting safe from Heathco International and adhering to best practices, you not only protect your assets but also improve the overall health of your business. We carry a diverse range of options for you to pick from, ensuring you find the perfect match for your exact business needs and budget.